Can You Write Off Lot Rent On Taxes . you can deduct property taxes you incurred for your rental property for the period it was available for rent. An important thing to consider is whether the. unfortunately, you can not deduct property taxes on your principal residence if you are not renting or using it for any business purposes. Understand what’s involved with rental income. Depending on your tax situation and province of. can you claim rent on your taxes as a deduction or credit?

from blog.turbotax.intuit.com

can you claim rent on your taxes as a deduction or credit? unfortunately, you can not deduct property taxes on your principal residence if you are not renting or using it for any business purposes. Depending on your tax situation and province of. An important thing to consider is whether the. Understand what’s involved with rental income. you can deduct property taxes you incurred for your rental property for the period it was available for rent.

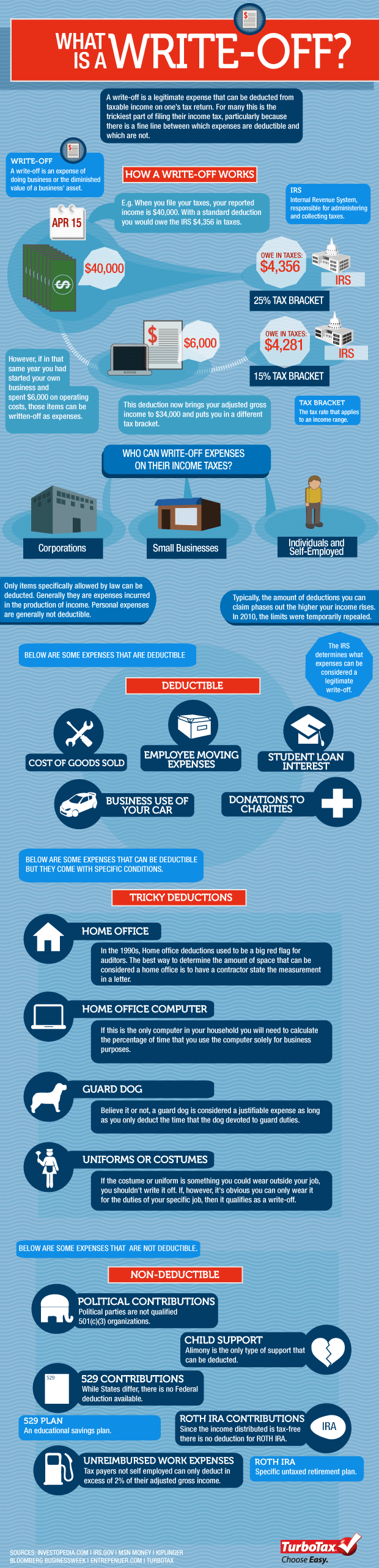

What is a Tax WriteOff? (Tax Deductions Explained) The TurboTax Blog

Can You Write Off Lot Rent On Taxes unfortunately, you can not deduct property taxes on your principal residence if you are not renting or using it for any business purposes. An important thing to consider is whether the. can you claim rent on your taxes as a deduction or credit? Understand what’s involved with rental income. Depending on your tax situation and province of. unfortunately, you can not deduct property taxes on your principal residence if you are not renting or using it for any business purposes. you can deduct property taxes you incurred for your rental property for the period it was available for rent.

From www.pinterest.com

10 Tax WriteOffs for Real Estate Agents in 2021 Tax write offs, Real estate advice, Saving money Can You Write Off Lot Rent On Taxes can you claim rent on your taxes as a deduction or credit? Understand what’s involved with rental income. you can deduct property taxes you incurred for your rental property for the period it was available for rent. An important thing to consider is whether the. Depending on your tax situation and province of. unfortunately, you can not. Can You Write Off Lot Rent On Taxes.

From printabledbnunez.z21.web.core.windows.net

Real Estate Tax Write Off Categories Can You Write Off Lot Rent On Taxes unfortunately, you can not deduct property taxes on your principal residence if you are not renting or using it for any business purposes. Depending on your tax situation and province of. Understand what’s involved with rental income. An important thing to consider is whether the. can you claim rent on your taxes as a deduction or credit? . Can You Write Off Lot Rent On Taxes.

From help.taxreliefcenter.org

What Can You Write off on Your Taxes [INFOGRAPHIC] Tax Relief Center Can You Write Off Lot Rent On Taxes Understand what’s involved with rental income. Depending on your tax situation and province of. you can deduct property taxes you incurred for your rental property for the period it was available for rent. unfortunately, you can not deduct property taxes on your principal residence if you are not renting or using it for any business purposes. can. Can You Write Off Lot Rent On Taxes.

From www.pinterest.com

How to Retire Early as a Millionaire in 7 Simple Steps Small business tax deductions, Tax Can You Write Off Lot Rent On Taxes Understand what’s involved with rental income. Depending on your tax situation and province of. unfortunately, you can not deduct property taxes on your principal residence if you are not renting or using it for any business purposes. you can deduct property taxes you incurred for your rental property for the period it was available for rent. can. Can You Write Off Lot Rent On Taxes.

From www.artofit.org

Taxes you can write off when you work from home infographic Artofit Can You Write Off Lot Rent On Taxes Depending on your tax situation and province of. you can deduct property taxes you incurred for your rental property for the period it was available for rent. unfortunately, you can not deduct property taxes on your principal residence if you are not renting or using it for any business purposes. An important thing to consider is whether the.. Can You Write Off Lot Rent On Taxes.

From www.forbes.com

12 Common Deductions You Can Write Off On Your Taxes Forbes Advisor Can You Write Off Lot Rent On Taxes Understand what’s involved with rental income. can you claim rent on your taxes as a deduction or credit? you can deduct property taxes you incurred for your rental property for the period it was available for rent. Depending on your tax situation and province of. An important thing to consider is whether the. unfortunately, you can not. Can You Write Off Lot Rent On Taxes.

From carlmorrison.pages.dev

Small Business Write Offs 2025 Carl Morrison Can You Write Off Lot Rent On Taxes you can deduct property taxes you incurred for your rental property for the period it was available for rent. unfortunately, you can not deduct property taxes on your principal residence if you are not renting or using it for any business purposes. An important thing to consider is whether the. can you claim rent on your taxes. Can You Write Off Lot Rent On Taxes.

From www.pinterest.com

how to write a tax write off cheat sheet Business tax, Tax write offs, Small business organization Can You Write Off Lot Rent On Taxes unfortunately, you can not deduct property taxes on your principal residence if you are not renting or using it for any business purposes. Understand what’s involved with rental income. Depending on your tax situation and province of. An important thing to consider is whether the. can you claim rent on your taxes as a deduction or credit? . Can You Write Off Lot Rent On Taxes.

From www.stoneoakmgmt.com

Tax Write Offs For Your Austin Rental Property Can You Write Off Lot Rent On Taxes An important thing to consider is whether the. can you claim rent on your taxes as a deduction or credit? Understand what’s involved with rental income. Depending on your tax situation and province of. you can deduct property taxes you incurred for your rental property for the period it was available for rent. unfortunately, you can not. Can You Write Off Lot Rent On Taxes.

From www.youtube.com

Investment Property How Much Can You Write Off on Your Taxes? PreReal Daily Blogs YouTube Can You Write Off Lot Rent On Taxes you can deduct property taxes you incurred for your rental property for the period it was available for rent. can you claim rent on your taxes as a deduction or credit? Understand what’s involved with rental income. unfortunately, you can not deduct property taxes on your principal residence if you are not renting or using it for. Can You Write Off Lot Rent On Taxes.

From www.pinterest.com

List of Things You Can Write Off on Your Taxes for Rental Property Tax deductions, Rental Can You Write Off Lot Rent On Taxes Understand what’s involved with rental income. you can deduct property taxes you incurred for your rental property for the period it was available for rent. can you claim rent on your taxes as a deduction or credit? unfortunately, you can not deduct property taxes on your principal residence if you are not renting or using it for. Can You Write Off Lot Rent On Taxes.

From www.youtube.com

Can You Write Off Home Improvements On Your Taxes? YouTube Can You Write Off Lot Rent On Taxes Depending on your tax situation and province of. Understand what’s involved with rental income. unfortunately, you can not deduct property taxes on your principal residence if you are not renting or using it for any business purposes. you can deduct property taxes you incurred for your rental property for the period it was available for rent. can. Can You Write Off Lot Rent On Taxes.

From www.youtube.com

Can you write off apartment rent as a business expense or deduction? YouTube Can You Write Off Lot Rent On Taxes Depending on your tax situation and province of. you can deduct property taxes you incurred for your rental property for the period it was available for rent. Understand what’s involved with rental income. unfortunately, you can not deduct property taxes on your principal residence if you are not renting or using it for any business purposes. An important. Can You Write Off Lot Rent On Taxes.

From fabalabse.com

What can a homeowner write off on taxes? Leia aqui What expenses can you deduct from your taxes Can You Write Off Lot Rent On Taxes you can deduct property taxes you incurred for your rental property for the period it was available for rent. unfortunately, you can not deduct property taxes on your principal residence if you are not renting or using it for any business purposes. An important thing to consider is whether the. Depending on your tax situation and province of.. Can You Write Off Lot Rent On Taxes.

From www.youtube.com

What is a Tax Write Off? Tax Deductions Explained YouTube Can You Write Off Lot Rent On Taxes Understand what’s involved with rental income. unfortunately, you can not deduct property taxes on your principal residence if you are not renting or using it for any business purposes. you can deduct property taxes you incurred for your rental property for the period it was available for rent. can you claim rent on your taxes as a. Can You Write Off Lot Rent On Taxes.

From aguyblog.com

Can I WriteOff Property Taxes? Here Is What You Need to Know A Guy Blog Can You Write Off Lot Rent On Taxes can you claim rent on your taxes as a deduction or credit? you can deduct property taxes you incurred for your rental property for the period it was available for rent. unfortunately, you can not deduct property taxes on your principal residence if you are not renting or using it for any business purposes. Understand what’s involved. Can You Write Off Lot Rent On Taxes.

From fabalabse.com

Can I write off the rent I pay? Leia aqui Can I use my rent as a tax write off Fabalabse Can You Write Off Lot Rent On Taxes Depending on your tax situation and province of. you can deduct property taxes you incurred for your rental property for the period it was available for rent. unfortunately, you can not deduct property taxes on your principal residence if you are not renting or using it for any business purposes. An important thing to consider is whether the.. Can You Write Off Lot Rent On Taxes.

From www.pinterest.com

Is Rental Property a Tax WriteOff? Morris Invest in 2024 Rental property management, Real Can You Write Off Lot Rent On Taxes unfortunately, you can not deduct property taxes on your principal residence if you are not renting or using it for any business purposes. can you claim rent on your taxes as a deduction or credit? An important thing to consider is whether the. Depending on your tax situation and province of. you can deduct property taxes you. Can You Write Off Lot Rent On Taxes.